Fed interest rate

Web The federal funds rate is the interest rate at which depository institutions trade federal funds balances held at Federal Reserve Banks with each other overnight. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

:max_bytes(150000):strip_icc()/ScreenShot2022-05-05at3.10.47PM-9401c217a6554ef38045747660cefed5.png)

How The Fed Funds Rate Hikes Affect The Us Dollar

We dont make judgments or prescribe specific policies.

. Easy account transfers mobile check deposit and automatic transfers. Web 9 hours agoThe Fed is currently targeting an interest rate range between 45 to 475. Web The Federal Funds Rate target range increased 25 basis points to 450 - 475.

See what makes us different. Yield Curve Models and Data. The Feds next meeting is May 2-3.

Web 2 hours agoThe Federal Reserve raised its benchmark interest rate by a quarter percentage-point in an effort to curb high inflation. Web The federal funds rate or fed rate is the interest rate banks pay one another to borrow or loan money overnight. Web Analyze the probabilities of changes to the Fed rate and US.

The current target range 425 to 45. When is the next Fed meeting. New York CNN Business.

Inflation at 65 in December 2022 is going in the right direction. Web 11 hours agoFed officials had been widely expected to nudge up their forecasts for how high rates would rise by the end of 2023 an estimate that stood at just above 5. Web 2 hours agoAnd in a series of quarterly economic projections the Feds policymakers forecast just one more hike in their key interest rate from its new level Wednesday of.

Web 39 rows Selected Interest Rates Yields in percent per annum na. Web 9 hours agoStocks wavered Wednesday as investors awaited the Federal Reserves interest rate hike decision at 2 pm. Web On Wednesday the Federal Reserve is expected to increase its benchmark federal-funds rate by 025 percentage points to between 475 and 5although some.

The Fed has put forward a string of borrowing. Heres a schedule of. Some had called for the Fed to wait.

Web Fed Funds Rate What it means. Ad Veterans Use This Powerful VA Loan Benefit for Your Next Home. Monetary policy as implied by 30-Day Fed Funds futures pricing data.

Ad Put your savings to work with one of the nations top savings rates. The interest rate on fixed federal loans has climbed from 373 to 499 in the last year and will likely rise again for new loans disbursed after. The Federal Reserve committed Wednesday to do more to help the US economic recovery promising more asset.

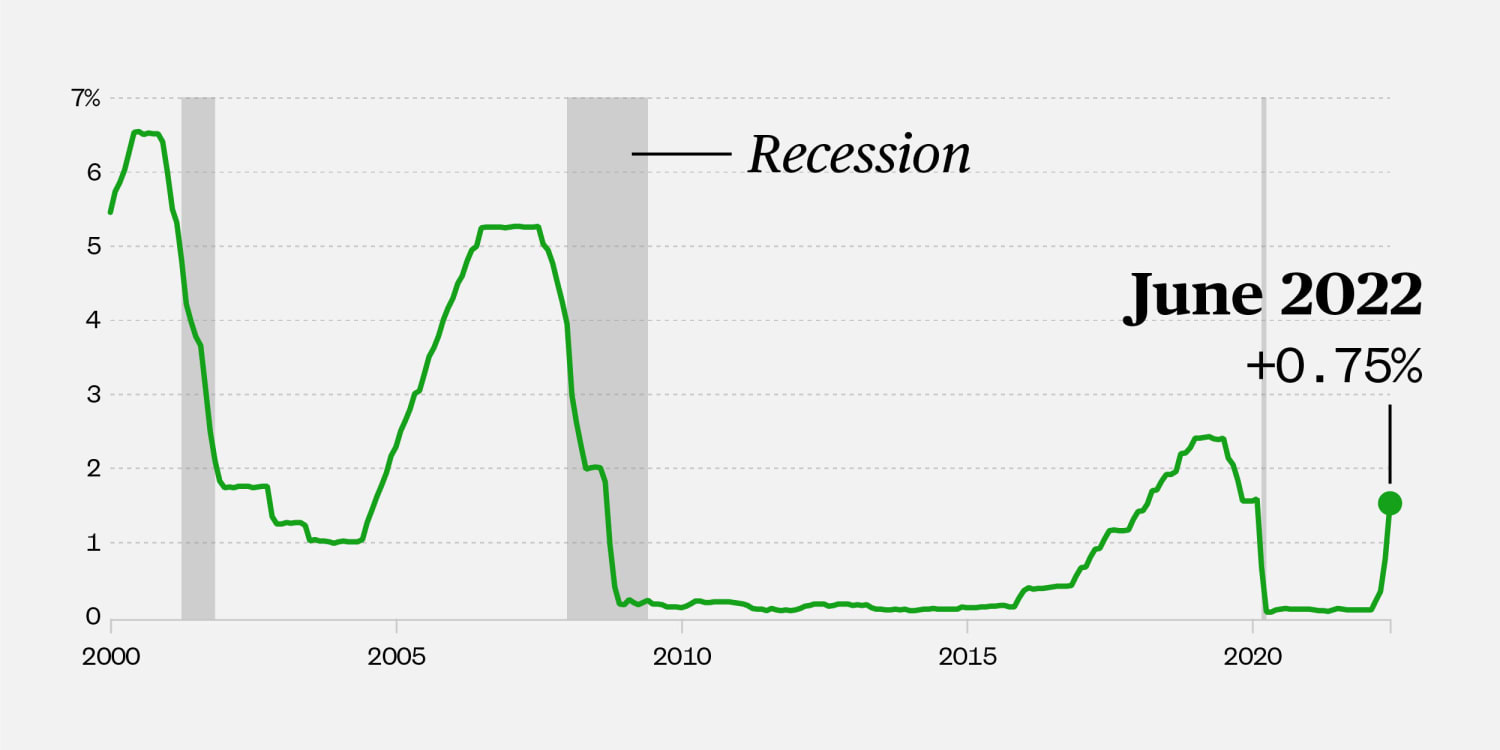

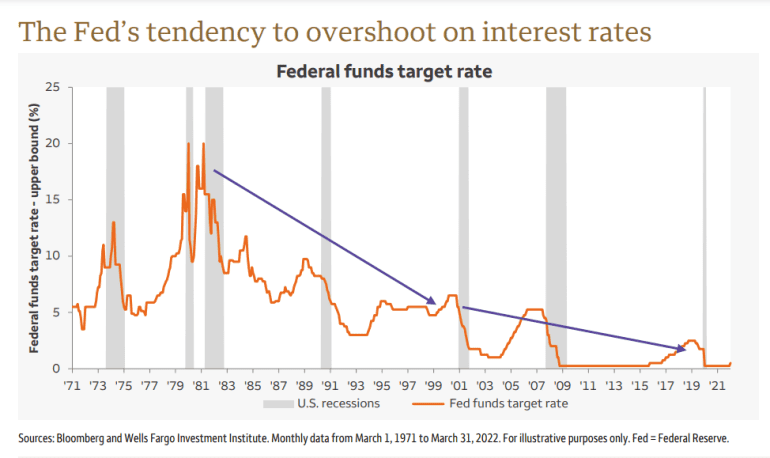

Web K8 - Holidays Observed by the Federal Reserve System 2017-2021. Web 11 hours agoOver the last year the Federal Reserve raised its benchmark interest rate by 45 the fastest pace since the 1980s. Please attribute rate probabilities used.

Web 2 hours agoStudent loans. Monthly Survey of Selected Deposits and Other Accounts. Traders see a roughly 88 probability of a.

Calculate Your Payment with 0 Down. See the Nations Top Bank Savings and Money Market Accounts. The interest rate at which banks and other depository institutions lend money to each other usually on an overnight basis.

Inflation Vs Short Term Fed Funds Interest Rate Look At How Closely Download Scientific Diagram

The Fed Raises Rates A Quarter Point And Signals More Ahead The New York Times

:max_bytes(150000):strip_icc()/GettyImages-1471928669-7a877363aebb444d9a0d03c2925b48ef.jpg)

Xaf31mtnc6xynm

Federal Funds Rate Vs S P 500 Us Market Collection Macromicro

Fed Raises Key Interest Rate By 0 75 As It Hardens Fight Against Inflation

How High Can The Fed Hike Interest Rates Before A Recession Hits This Chart Suggests A Low Threshold Marketwatch

Us Fed Interest Rate Cut By 50bps Alpinum Investment Management

Za9d Sadlt7atm

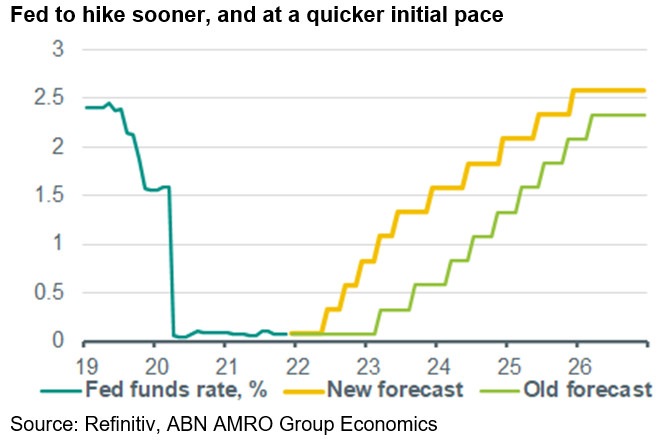

The Looming Fed Ecb Policy Divergence Abn Amro Bank

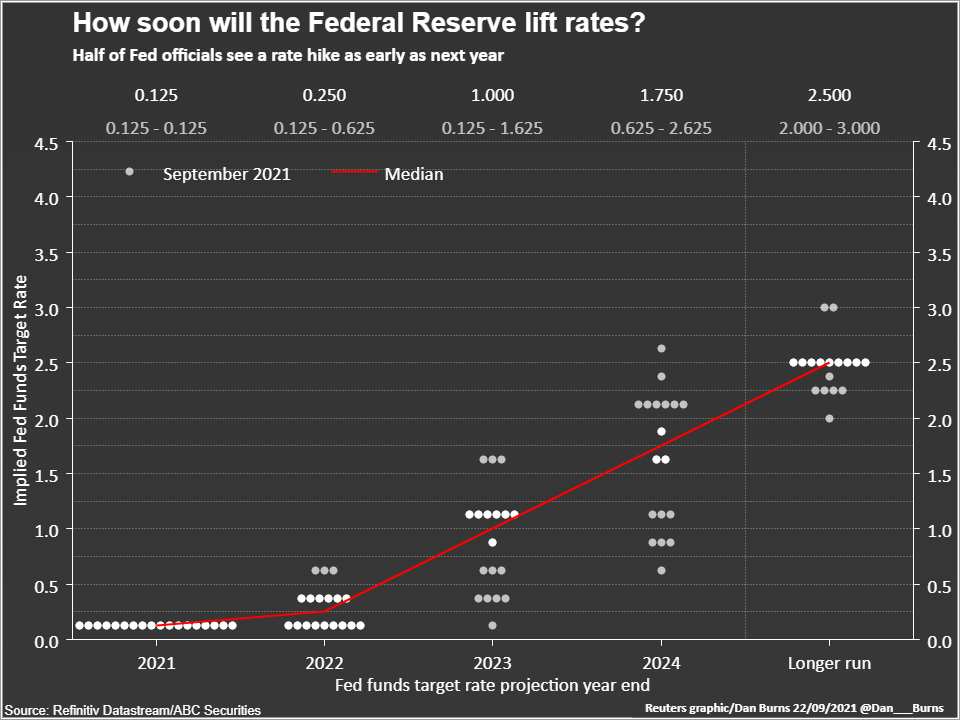

Federal Reserve Approves First Interest Rate Hike In More Than Three Years Sees Six More Ahead

Don T Worry Too Much About A Fed Interest Rate Hike Fivethirtyeight

How Far Will Or Can The Us Federal Reserve Take Interest Rates Aj Bell

Federal Funds Rate Wikipedia

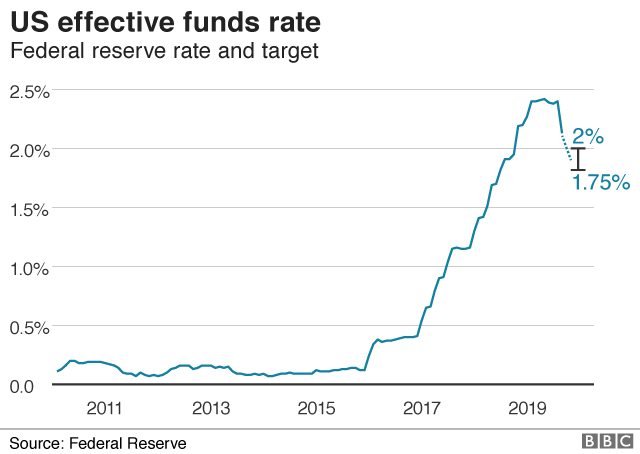

Us Fed Cuts Interest Rates For Second Time Since 2008 Bbc News

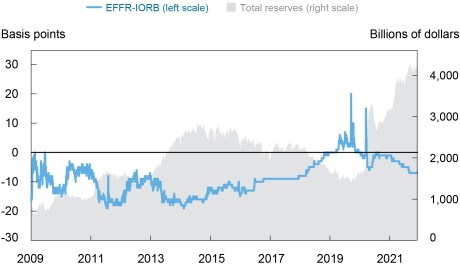

How The Fed Adjusts The Fed Funds Rate Within Its Target Range Liberty Street Economics

Cmpy4e1wrclrom

Bthc4ihhn8hbnm